What CWCC can do for you under the travel restrictions

Under the unprecedented Corona Pandemic, the travel restrictions have made movement of people from one county to the other so difficult. This is affecting the foreign investors in setting-up and performing business operations. It would be very convenient if they can set up their operations without their presence in the places that they target to enter. It is not expected that these travel restrictions to be raised any time soon and losing business opportunities would be looming if there is no effective countermeasure is established. We are here to help those investors not to miss out the opportunities in Hong Kong as well as the People’s Republic of China where the business is coming back in the fast pace.

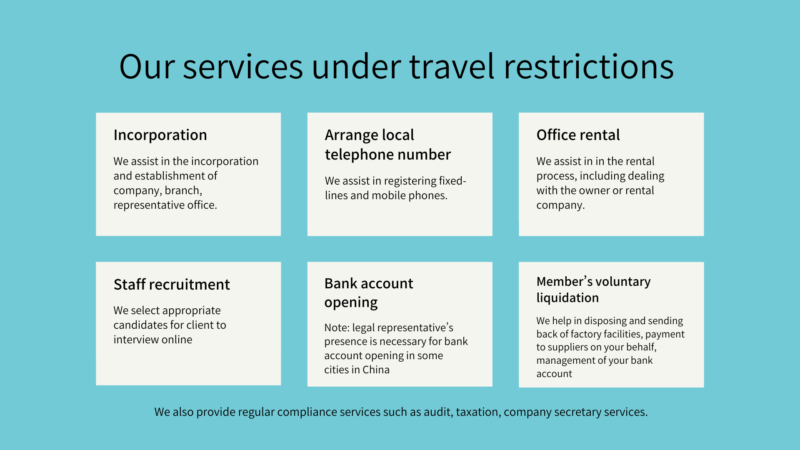

This is where CWCC comes in to help you for not only setting-up companies but also helping registering telephone lines, arranging mobile phones, office rental (including dealing with owner/rental company), recruitment of staff (selecting appropriate candidates for client to interview online), or any other things that we can do for you who wish to start business in Hong Kong and/or China (legal representative’s presence is necessary for bank account opening in some cities in China). We can discuss with you to what extent we can manage to support your operations as well.

On the different note, we can also take up member’s voluntary liquidation of companies even without your presence. There are many aspects to this matter (such as disposing and sending back of factory facilities, payment to suppliers on your behalf, management of your bank account, etc). You will feel overwhelmed if you need to deal with all kinds of matters together with a few different professional parties such as auditor, tax professional, company secretary etc. We can take up your role and do the winding-up on behalf of you. It is important for us to have your collaboration but it will relieve your work tremendously.

We are the very few service providers who can provide such extra services together with our main line of compliance services such as audit, taxation, company secretary service etc. We can best use of web meeting, telephone, email, social media tools for good and smooth communication. We are proving that most of our business can be done online. Let us help you going forward.

Our well-experienced professional staff will be serving you and we are capable in dealing with different language such as Cantonese, Chinese, English and Japanese. So you can feel at ease to contact us and be rest assured that you will be in good hands. The following is two real life examples to show how CWCC could help:

Company A from the USA

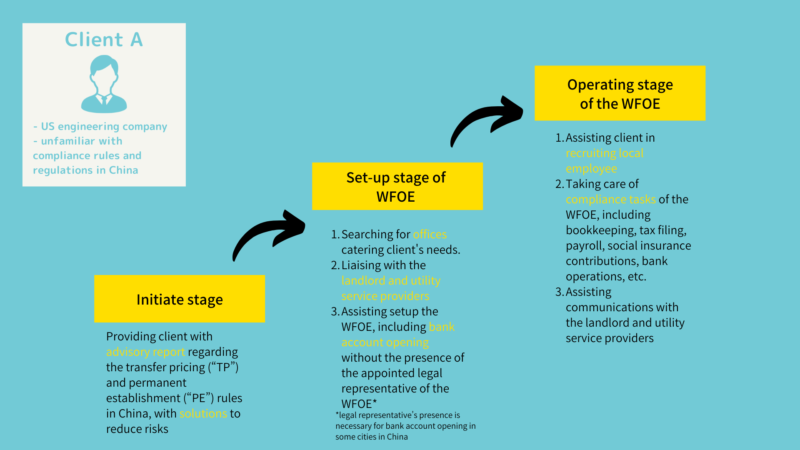

Background:

Company A is a famous engineering company incorporated in the USA and which is engaged by a Theme Park in China to design and install roller coasters. Company A is unfamiliar with the compliance rules and regulations in China. We are engaged by Company A to provide advisory and ongoing services:

At the initiate stage:

We prepared an advisory report regarding the transfer pricing (“TP”) and permanent establishment (“PE”) rules in China. In addition to explain the PRC rules and also evaluate the potential respective TP and PE risks faced by Company A, we also provide solutions to Company A in order to reduce the potential risks.

Company A decided to set up a wholly foreign owned enterprise (“WFOE”) in China regarding the project.

At the set-up stage of the WFOE:

- After in-depth understanding of Company A’s requirements, we searched several offices for Company A’s consideration.

- Then we assisted to liaise with the landlord and utility service providers to conclude tenancy agreement and also the respective utility services.

- We assisted to setup the WFOE, including bank account opening without the presence of the appointed legal representative of the WFOE.

Operating stage of the WFOE:

- We assisted Company A to recruit local employee by posting job advertisement in some job searching websites, assist to screen out candidates for the first interview, interview the candidates, then propose some potential candidates to Company A to do the final interview via Zoom. Company A finally recruited two local employees through our assistance.

- We take care the monthly and annual compliance tasks of the WFOE, including bookkeeping, tax filing, payroll, social insurance contributions, bank operations, etc. We send monthly management report to Company A and assist the management to closely monitor the financial and operations of the WFOE.

- In addition to local employee, Company A also second expatriates from USA to China. We assist the expatriates to communicate with the landlord and utility service providers.

Conclusion:

The management of Company A has not travelled to China to manage and control the WFOE.

Client from Japan

Background:

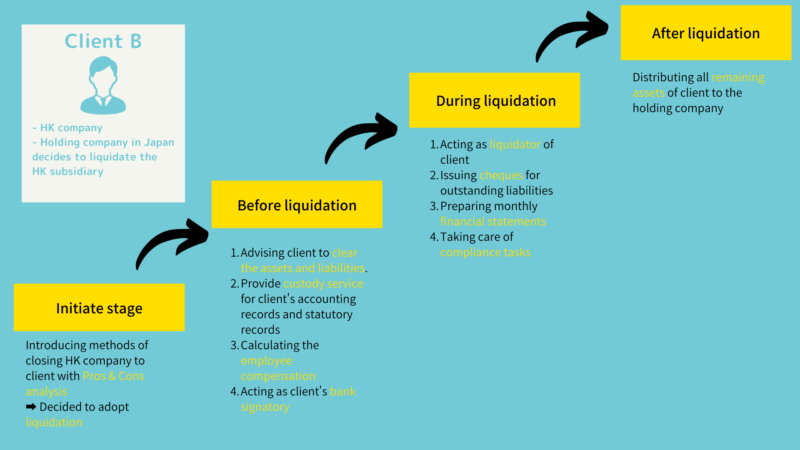

Company B is a financial institution incorporated in Hong Kong with the ultimate holding company listed in Japan (“Company JP”). Company JP decided to liquidate Company B due to group and operation reconstructions. We are engaged by Company JP to handle the liquidation process of

Company B:

At the initiate stage:

- In general, there is two methods to close a Hong Kong limited company, by deregistration or liquidation.

- We elaborated the differences, pros and cons of the two methods to Company JP.

- Company JP decided to close Company B via liquidation.

Before liquidation:

- We advised client to clear the assets and liabilities of Company B as much as possible.

- We assisted to keep the accounting records and statutory records after all employee of Company B were dismissed.

- We assisted to calculate the employee compensation.

- We acted as the bank signatory of Company B

During the liquidation:

- We were appointed as the liquidator of Company B.

- We issued cheques for some not yet settled liabilities after obtaining the approvals from Company JP.

- We prepared monthly financial statements of Company B for Company JP’s reference.

- We took care the compliance requirements of Company B during the liquidation process.

After the liquidation:

- We, as the liquidator, distributed all remaining assets of Company B to Company JP after the liquidation is approved by the authorities.

Conclusion:

Company B has been liquidated smoothly and within the estimated time frame. The liquidation was completed without the presence of any employee of Company JP and under the situation that all employee of Company B had been dismissed or gone back to Japan.

: +852 2956 3333

: +852 2956 3333  :

:

Comments are closed.